Panic! at the stock market

Note: This article was originally published on March 12, 2020. Between Feb. 12 and March 23 of 2020, the stock market lost approx. 1/3 of its value. The Coronavirus crash of 2020 separated many people from their money-- those who panicked and sold. As of March 13, 2022, despite the recent correction, the stock market (with dividends reinvested) has almost exactly doubled since the Coronavirus bottom.

Unless you have been living under a rock, the chaos in the financial markets over the Covid-19* pandemic has undoubtedly caught your attention and may have you wondering if now is a good time to get out of the stock market. The answer now and always is an emphatic no. Below are some comments and observations that are relevant and helpful during market panics like this one:

- Your feelings of anxiety and helplessness are completely normal; the world is a scary place and those emotions are amplified because of the internet and social media. Covid-19 has thrown the entire world into a panic.

But here's a very important question to ask yourself:

When was the last time you made a good financial decision based on your feelings and emotions in a moment of global panic?

Good financial decisions are made based on historical evidence, logic, and sound reason during calm financial markets and with an eye on long-term financial success.

If you are a client of mine, that's exactly what we have done together in the near past. Your financial plan was constructed to withstand this type of market behavior.

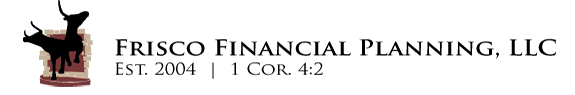

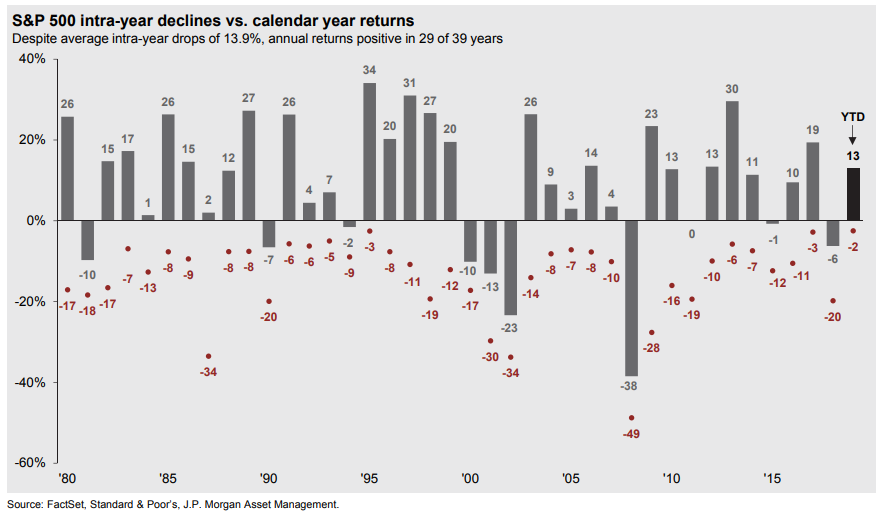

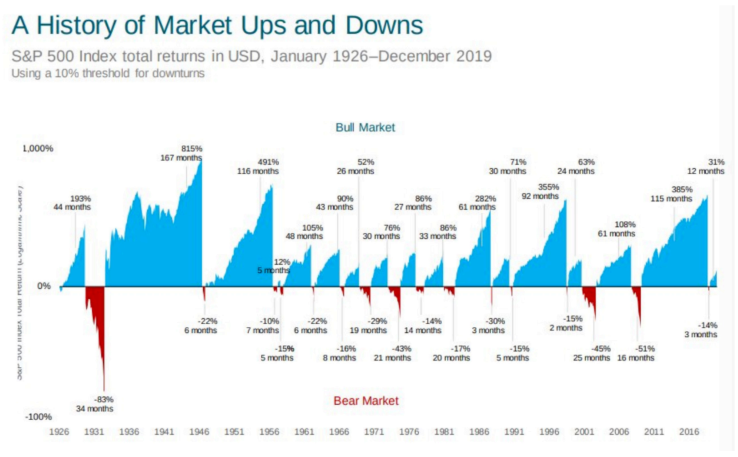

- Covid-19 is not without precedent. There are, in fact, too many precedents to count. This is normal market behavior. Every 3-4 years, on average, a bear market (20% loss) happens. We haven't had one in quite a while and the stock market gained 30% last year. Short-term stock market declines, sometimes very significant ones, are what allow long-term stock market advances. Put another way, if the stock market never went down, investors wouldn't require a very high rate of return to compensate them for taking the risk (think bank accounts and CDs).

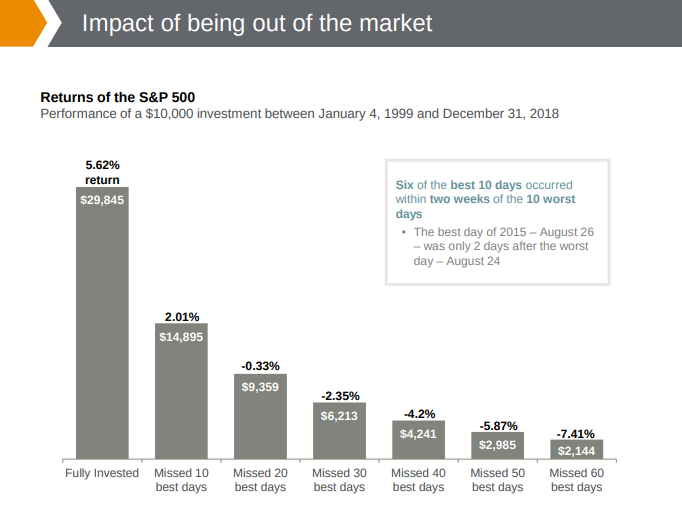

- Market recoveries are usually very swift and unexpected. If you think you can get out of the market and then get back in again, think again. There is an overwhelming amount of evidence against anyone's ability to successfully and consistently time the market (and in this context, consistently means twice-- once when you get out and again when you get back in).

- Selling stocks when the market tanks is totally illogical so why is it happening? Investors are not driving the market lower. Traders and speculators are. Which one are you? If you are an investor, know this: the mainstream financial media are not your friend. Traders and speculators, with their partners in the media (many of whom publish blogs from their parent's basement) have only one goal: to separate you from your money.

This call was made within weeks of the bottom of the great recession decline, immediately followed by a decade of higher than average stock market returns and a quick return to the days of low unemployment, low inflation, and solid economic growth.

In old testament times, false prophets were stoned outside the city gates; Wall Street sang his praises and gave him a raise.

-

It's probably not as bad as you think. If you have followed my advice, you aren't anywhere near 100% invested in stocks. You don't own individual securities which are far riskier than "the entire market," and you don't own complicated, expensive and risky "alternative investments." You have rejected expensive and tax-inefficient "actively-managed" funds. Consequently, whatever the daily market declines amount to, you have most likely only experienced a fraction of the loss.

-

What does the evidence say? The evidence of the best course to take during market downturns is overwhelming and conclusive: don't sell stocks when they are down.

Every previous market high looks really low after some time goes by.

-

There are only two possible outcomes and you can't invest for both: Total financial armageddon or long-term financial prosperity. You must choose one or the other because they are mutually exclusive. If you invest with one in mind and the other occurs you will be financially ruined.

-

If you are retired (assuming, again, that you have followed my advice), you have significant cash and bonds in your portfolio to weather even a significant and prolonged downturn. You are familiar with a reasonable sustainable portfolio withdrawal rate and you are sticking to it. If possible, you are making reasonably easy adjustments to your lifestyle (ie, postponing that trip to Europe). Wonderful, that's exactly what you should do, all you can do, and all you need to do. If you are not yet retired, you are not selling stocks. If you are many years from retirement, you are probably buying stocks, perhaps in significant periodic dollar amounts. Congratulations, you are now buying stocks on the cheap. If you are 20 or more years away from retirement, a significant market downturn like this one is a gift.

One last thing: I am available to speak with you about your investments and your financial plan, particularly during times like these. This is my job and it's what I signed up for so please take me up on it. Call me or reserve at time on my calendar any time.

*I have sent out a version of this article many times; the bulk of the content has remained the same over my 30 year career. Whenever you see Covid-19, feel free to substitute other historical financial crises such as Russian invasion of Ukraine, inflationary Fed interest rate hikes, the great recession, 9/11, SARS, H1N1, Ebola, JFK assassination, arab oil embargo, y2k, gulf wars, long-term capital management collapse, tech bust, etc.